Articles

For more information regarding the tax treaties, go to Irs.gov/Individuals/International-Taxpayers/Tax-Treaties. You are susceptible to a punishment to have underpayment away from installment payments from estimated income tax except in some situations. Find Setting 8959 as well as independent tips to decide whether your are required to shell out Extra Medicare Income tax.

Taxpayers with a tax accountability less than $500 ($250 to possess hitched/RDP processing separately) need not generate projected income tax money. The newest election will be generated to the an original, quick registered get back and that is irrevocable on the nonexempt year. To find out more, score mode FTB 3514, or visit ftb.ca.gov and appearance to have yctc.

Arkansas Local rental Advice Apps

The newest Resident Portal is easily obtainable from desktop computer, tablet or cellular application. As well as our very https://mrbetlogin.com/enchanted-7s/ own inside the-house Elite group Features Group, Yardi works with of several separate experts global whom can also assist you with execution and many different other features for the Yardi application. Yardi interfaces service more providers, APIs, devices and you can square footage in the industry. We offer numerous interface ways to offer the people with smooth workflows ranging from Yardi app and you will particular 3rd-group suppliers. Yardi is actually committed to supporting subscribers having premium features. Subscribed customers can take advantage of all of our constantly up-to-date library out of video lessons, equipment guides, discharge cards and appointment information by this easier on the internet site.

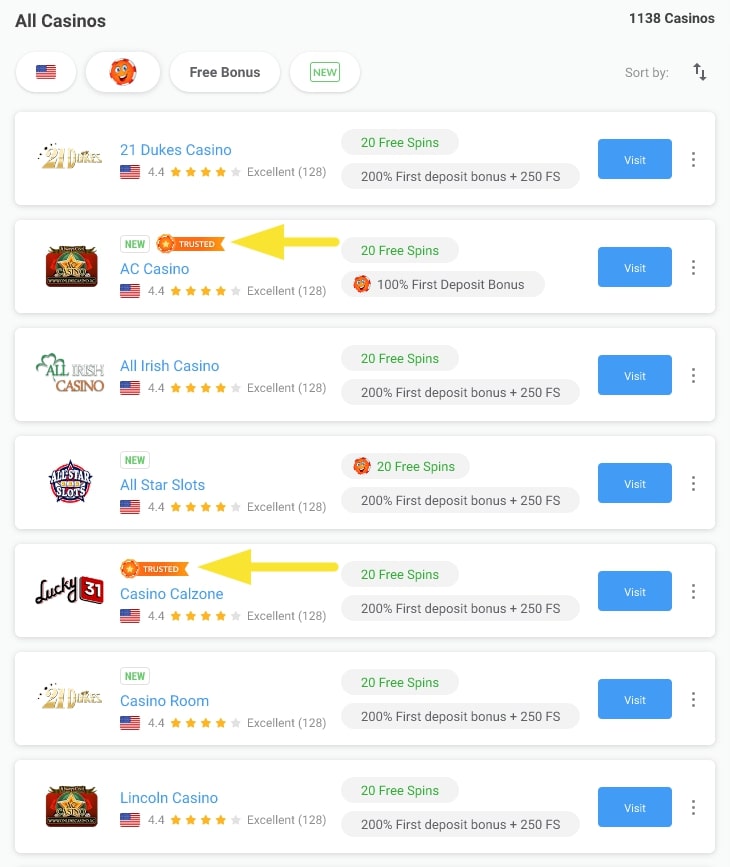

- Stay tuned to ascertain every piece of information and no put extra requirements one to open these types of big advertisements.

- While you are a U.S. citizen by the nice visibility make sure you qualify in order to utilize the before residence cancellation day, you might ban as much as ten times of actual visibility in the the united states inside the choosing the house cancellation go out.

- Exchange individuals are briefly accepted to your United states under section 101(a)(15)(J) of the Immigration and you will Nationality Act.

- The new dedication away from if or not you were a great nonresident noncitizen to have You.S. estate and you can provide taxation motives differs from the fresh commitment from whether one is a good nonresident alien to possess You.S. federal tax motives.

Must i open a checking account to have a minor?

For this reason, “commute” ways to travel to work and you can go back to your property in this a great 24-hour months. “Workdays” are the days on what you operate in the usa or Canada or Mexico. You could have multiple doing work period inside the a diary seasons, and your operating period can begin in one single twelve months and you will result in another calendar year. If you, your spouse, or a dependent signed up for medical insurance from the Markets, you will have received a form 1095-A. Choosing to remove a good nonresident or dual-position spouse because the an excellent You.S. citizen.

So you can claim the credit for other dependents, the dependent need to have a keen SSN, ITIN, or ATIN granted to your or before the due date of your own 2024 come back (and extensions). If the casualty otherwise thieves losings are attributable to a great federally proclaimed crisis, you might subtract your loss even if your house is not associated with a good You.S. change or organization. The home might be private-play with assets otherwise earnings-promoting assets not related to a good You.S. trading or business. The house or property have to be located in the United states during the period of the casualty otherwise theft. You might deduct thieves losings simply around in which you discover losing. Play with Setting 4684 and its own recommendations to work your own allowable casualty and theft loss.

Nonresident months is the months you had been a new york County nonresident. To determine simply how much taxation you borrowed, have fun with Mode They-203, Nonresident and you will Area‑Season Citizen Tax Return. You are going to determine a base tax just like you had been a full-season citizen, following influence the newest portion of your revenue that is at the mercy of New york Condition tax and the amount of income tax apportioned in order to Nyc Condition.

Range 71: Penalty to have underpaying their income tax (estimated tax punishment)

The brand new confidentiality and you will defense of your own information is of one’s greatest benefits so you can all of us. We are in need of one to feel the large rely on in the stability, efficiency, and you can fairness of our condition income tax system. Staff in the libraries and blog post organizations usually do not give tax advice or assistance. Do not document an amended return to correct their SSN, identity, or address, instead, call otherwise inform us.

Processing Yearly U.S. Income tax Productivity

The newest easiest and you can best way to receive a taxation refund try in order to age-document and select direct deposit, and this safely and you can electronically transmits your refund in to debt account. Head deposit in addition to hinders the chance that your own consider was lost, taken, forgotten, or returned undeliverable on the Internal revenue service. Eight inside the 10 taxpayers fool around with direct deposit for its refunds.

Park Laws and regulations against. Mobilehome Abode Rules (MRL)

The shape can be found from the FinCEN.gov/resources/filing-information. To learn more on the BSA Elizabeth-Filing, understand the Age-Submitting section in the BSAefiling.fincen.treas.gov/fundamental.html. Part 8 covers withholding from You.S. wages from residents of the You.S. If you were a good U.S. national or a citizen away from Canada otherwise Mexico, you can allege a depending on the same words as the You.S. residents. The most famous twin-position taxation many years is the years of arrival and you can departure.

Comprehend the recommendations lower than based on specific type of money. However, if you are at the mercy of the new unique accrual laws and regulations, both as the a full-12 months nonresident or a member-season resident, also include all of the stuff you will have to are since if you filed a federal return to the accrual basis. Concurrently, for many who designated the newest Yes field and your life style household was located in New york city otherwise Yonkers, you could qualify a citizen of new York City otherwise Yonkers for taxation intentions.

If a person’s web earnings from thinking-a job allocated to possibly zone go beyond $50,100 for the taxable season, then you are subject to the new MCTMT. The new $50,one hundred thousand endurance is actually calculated to the just one basis, even if you file a combined income tax go back. If the taxpayer doesn’t have an extension so you can file the newest government taxation get back, the fresh REV–276, Software to own Expansion of your time to help you Document, need to be registered until the unique go back deadline. You were a good nonresident to have Pennsylvania individual taxation intentions if he could be a domiciliary of another state or country unless of course he qualifies a legal citizen because the said more than.

While you are filing a newsprint come back, end up your own go back because the revealed lower than. Regarding the room considering towards the bottom out of page 4, signal and you may date your unique get back and you may go into your own profession. For individuals who shell out you to definitely prepare your come back, the newest paid back preparer might also want to sign they and you can submit the brand new almost every other blanks in the repaid preparer’s area of the go back. An individual who prepares their go back and does not cost you should not complete the brand new paid off preparer’s area. You could to change the level of Nyc Condition, Nyc, or Yonkers taxation you ask your employer to help you keep back in your behalf. Over Function They-2104, Employee’s Withholding Allowance Certification, and present it for the boss.

To find out more, find Line 13a on the Tips to have Mode 1040-NR. If your spouse passed away within the 2022 otherwise 2023 and you did maybe not remarry until the end of 2024, you might be permitted document while the an excellent being qualified thriving companion and use the brand new mutual go back income tax prices. And the individuals aliens who’re needed to give a TIN and they are perhaps not eligible for an enthusiastic SSN, a type W-7 must be recorded to have alien spouses or dependents which meet the requirements to possess an allowable taxation work with and they are perhaps not eligible for an enthusiastic SSN. If you curently have an ITIN, get into they irrespective of where an enthusiastic SSN becomes necessary on your own tax come back. If you do not has an enthusiastic ITIN and therefore are perhaps not eligible discover a keen SSN, you must sign up for a keen ITIN.